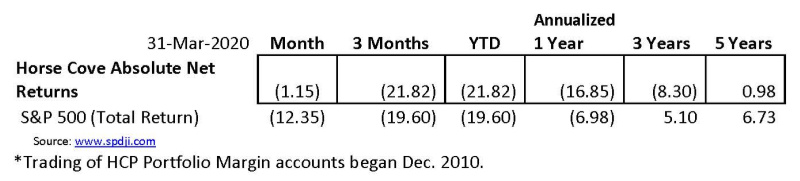

The March 31, 2020, month-end performance estimate for the Horse Cove Partners Absolute Return Strategy is down (1.15%) net of fees1. Since the December 2010 inception of trading, the Strategy has achieved a total cumulative return of +203.04% net of fees.

Market Recap and Commentary

S&P 500 Total Return Index lost (12.35%) in the month of March.

From all appearances, the longest-running bull market in U.S. history has come to an end with the market’s turn in February.

As we write this update, we have been trading through some of the worst volatility in the last 30 years. The global impact of the Corona Virus is causing the markets to reel in ways we have not seen before.

Things accelerated down mid-February, with the DOW falling from a new high to a 10% correction in only 6 trading days. That was the fastest time period for that to happen since 1928. Source: Bloomberg.

We have seen more daily 2% +/- swings in the market in history. The Dow has had the largest point drops and gains in history.

It feels like 2008 all over again. In the fall of 2008, volatility spiked to 84% and averaged over 50% in the fourth quarter of 2008. There were huge opportunities to sell premium, but it took a few weeks for things to become more stable after the initial drawdowns.

In our view, things are still unstable and we are erring on the side of caution, expecting that the economic effects of Covid-19 are not going to be fully absorbed by the market in a few trading days.

If Covid-19 turns out to be the “black swan” that finally ended the historic bull market, and the economies of the world will struggle for years to get back on track, we believe in our strategy to navigate us forward. When markets stabilize from the current irrationality, they should move forward maintaining a healthy fear, which means our trade is much further out of the money for significantly more premium. Unlike our two most recent losses that turned out to be short term shocks to parts of the system, this is a long-term issue that will continue to weigh on the markets as they attempt to reprice the risk.

Performance and Trading Update

Horse Cove Partners Absolute Return Strategy composite was down (1.15%) net of fees.

Thanks to our risk controls and quick action we were able to minimize losses to the portfolio that could have been significantly worse, leaving us with the capital to take advantage of a prolonged period of heightened fear and substantially higher premiums. While the market finds its feet, we are keeping our trades shorter and much further out of the money. As we mentioned earlier, we believe we are entering a well-suited market environment for our trade.

Here are the composite net returns for the Portfolio Margin accounts for the periods indicated:

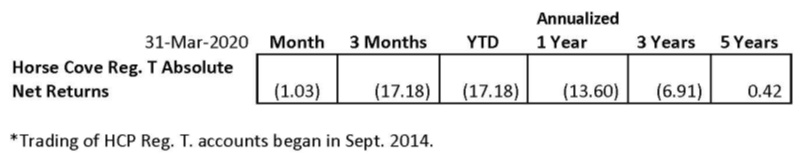

Reg. T Update

IRA accounts must use Reg. T Margin which means that fewer option contracts may be written than in the “regular” accounts that use Portfolio Margin. Over time, this may also result in lower returns when compared to the “regular” accounts.

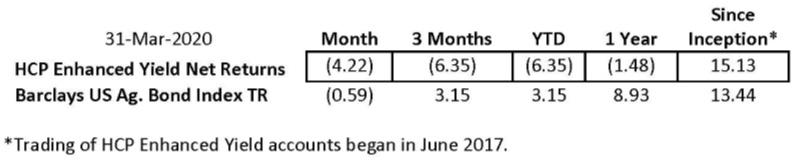

HC Enhanced Yield Update

Here are the composite net returns for the Enhanced Yield Strategy for the periods indicated:

What is likely next?

This has felt an awful lot like 2008 to us, where it took months to reach bottom while volatility remained high. Bear markets do not typically occur in one catastrophic drop. There is an initial plunge, then stabilization and a bear market rally followed by more moves lower. We have seen the first two parts of that play out so far.

The stock market initially fell about 30%, then a relief rally up of approximately 20% from the bottom. If history repeats itself, next we are likely to see another leg down and the lows being tested or broken. The low in the S&P 500 is 2191.86.

With over 10 million jobless claims filed in two weeks (Source: Bloomberg) and most of the U.S. under some form of lockdown, we are not expecting a quick V-shaped recovery. Rather, we expect there to be an extended period of high volatility. Again, if history repeats itself, that kind of environment is very well suited for our strategies collecting premiums against fear.

We hope you are all safe and coping well in these challenging times.

About Horse Cove Partners LLC

Profiting from the art and science of taking risk. ®

Horse Cove Partners was founded by Sam DeKinder and Kevin Ellis in January of 2013 with the commitment to help grow the client’s assets with a highly disciplined investment strategy, replicated weekly, to extract absolute returns from the market by trading short volatility option spreads. The firm was launched after more than two years of trading experience with personal assets that began in December 2010. The firm is built on the strength of hedge fund trading expertise developed beginning in 2002.

Assets under management at the end of March 2020 were $56.64 million.

“We do not believe we are smarter than the market, nor can we time the market in any given week or month. As a result, we take an investment approach similar to an insurance company in that our investment strategy focuses on the probability of success and the management of risk. We believe that it is possible to realize positive returns through a disciplined focus on the risk of each trade with a weekly investment horizon, and accepting intelligent losses when risk events occur.”

We thank you for your continued support.

Sincerely,

Sam DeKinder, Kevin Ellis

Greg Brennan

John Monahan

Michael Crissey

Don Trotter

sdekinder@horsecovepartners.com

kellis@horsecovepartners.com

gbrennan@horsecovepartners.com

jmonahan@horsecovepartners.com

mcrissey@horsecovepartners.com

dtrotter@horsecovepartners.com

Horse Cove Partners LLC

1899 Powers Ferry RD SE

Suite 120

Atlanta, GA 30339

678-905-5723 main

1Net estimate on a consolidated basis of similar accounts as of 3.31.2020, which is preliminary and subject to revision. Performance estimate described herein as “YTD” are net of fees and expenses including a 2% per year management fee and 20% incentive fee and assumes investors have been invested the entire time with no withdrawals. Individual account returns may vary depending on cash flows, the time period assets are invested, and restrictions placed on the account.

This was prepared by Horse Cove Partners LLC a federally registered investment adviser under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply a certain level of skill or training. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser. Additional information about our firm is also available at www.adviserinfo.sec.gov. You can view the firm’s information on this website by searching for our firm name.

THIS MESSAGE AND ANY FILES TRANSMITTED WITH IT ARE CONFIDENTIAL AND PRIVILEGED. IF YOU ARE NOT THE INTENDED RECIPIENT, PLEASE NOTIFY THE SENDER IMMEDIATELY AT 1 (678) 905 5723. IF YOU ARE NOT THE NAMED ADDRESSEE YOU SHOULD NOT COPY OR DISCLOSE THE CONTENT OF THIS MESSAGE AND ANY FILES TRANSMITTED WITH IT TO ANY OTHER PERSON.

Internet communications are not secure and subject to possible data corruption, either accidentally or on purpose, and may contain viruses. The content of this message should not be construed as investment advice unless explicitly stated as such in the text of this message. Further, this message should not be construed as the solicitation of an offer to purchase or an offer to sell any securities or other financial instruments, including, without limitation, interest in any private investment managed by Horse Cove Partners LLC or any of its affiliated entities.

This material has been prepared solely for informational purposes only. Strategies shown are speculative, involve a high degree of risk and are designed for sophisticated investors.

Past performance is not a guarantee of future results. Investing involves risk, including the possible loss of principal and fluctuation of value. The information herein was obtained from third-party sources. Horse Cove does not guarantee the accuracy or completeness of such information provided by third parties. All information is given as of the date indicated and believed to be reliable. Performance results are estimates pending a verification. The returns are based on the Investment Manager's strategy and the compilation of actual client account trades. The Horse Cove Absolute Return and IRA Return strategies seek to extract absolute returns from the market by trading short volatility option spreads. The Enhanced Yield strategy seeks to achieve a targeted return trading only puts with a high probability of success.

The strategies reflect the deduction of advisory fees and any other expenses that a client would have paid or actually paid. The S&P 500 Index is used for comparative purposes only. The volatility of an index is materially different from that of the model portfolio. The S&P 500 refers to the Standard and Poor's 500 Index which is a capitalization-weighted index of 500 stocks. The index is designed to measure the performance of the broad domestic stock market. The VIX (CBOE volatility index) is the ticker symbol for the Chicago Board Options Exchange (CBOE) Volatility Index, which shows the market's expectation of 30-day volatility. It is constructed using the implied volatilities of a wide range of S&P 500 index options. This volatility is meant to be forward-looking and is calculated from both calls and puts. The VIX is a widely used measure of market risk and is often referred to as the "investor fear gauge." Investors cannot invest directly in an index. An index does not charge management fees or brokerage expenses, and no such fees or expenses were deducted from the performance shown. Options trading entails a high level of risk. The models do not include the reinvestment of dividends and capital gains because options don't pay dividends. Please read the Characteristics and Risks of Standardized Options available from the Options Clearing Corporation website: http://www.optionsclearing.com for further details.