The month-end performance estimate as of December 31, 2014 for Horse Cove Partners Absolute Return Strategy is +3.01%, net of fees1. For 2014 year, the strategy return is +13.44%, and since the inception of trading in December 2010, the strategy has achieved a total cumulative return of +161.41%.

Market Recap and Commentary

For the month of December, the S&P 500 Total Return Index fell (-0.25%). Along the way, we saw a dramatic zig-zag in the market. On December 1, the S&P 500 opened December at 2065.78, fell (4.51%) to a low of 1972.56 on December 16 and then rallied up 6.13% to a new all-time high on December 29, 2014 at 2093.55. The month closed out on the 31st at 2058.90.

The decline of 1% on the last trading day of the year was only the fifth time that has happened since 1950, and set the stage for the declines we are now witnessing as January kicks-off.

Volatility was just as up and down as the market, with a low during the month of 11.53% and a high during the sharp decline in mid-December of 23.90%.

Looking back at 2014, our results are tied to the low volatility environment that appears to be ending. The historical average VIX is about 20%. The average VIX in 2014, measured on a weekly closing basis, was 14.17%

Oil is dominating the story right now. With crude losing over half of its value, the story line of more money for consumer spending is giving way to concerns that the global economy is much weaker than is being generally reported.

Performance and Trading Update

December was a solid month for trading with little margin pressure even though the market was on a bit of a roller coaster ride. Our decision to ease up slightly on our collateral usage appears to be working, as we had little margin pressure during the trading month.

We wrote puts and calls an average of 5.75% and 3.1% out of the money respectively. But the range was significant as volatility changed each week. By keeping our focus on the risk of the trade each week, rather than a set percentage out of the money or a targeted return each week, we adjust our percentage out of the money every week. We wrote puts in a range from 4.3% to 7% out of the money during the month. This is one of the “simple” yet powerful details of the Horse Cove Absolute Return strategy.

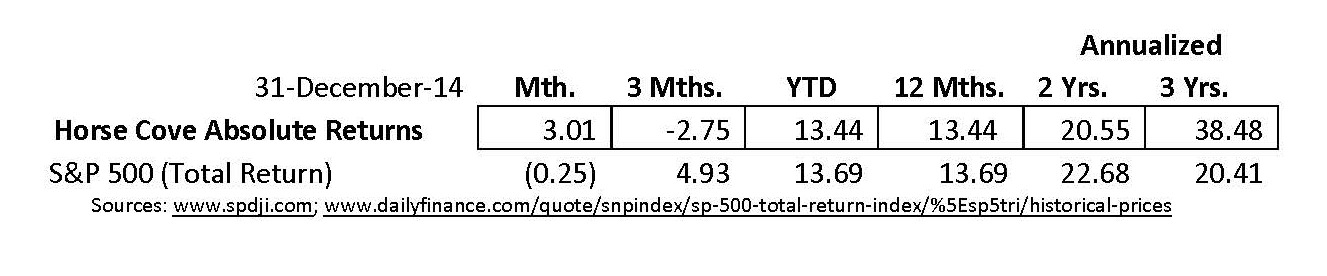

Here are the returns versus the S&P 500 total return index for the periods indicated:

IRA Update

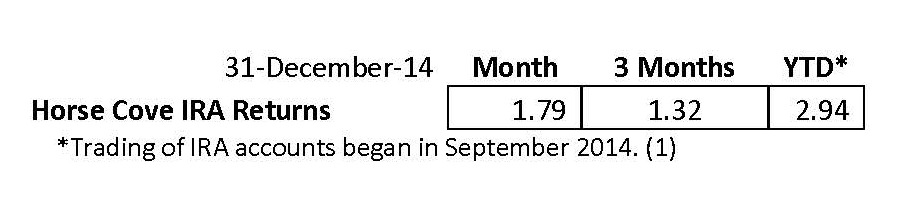

Here are the returns for the consolidated IRA accounts for the periods indicated:

Looking Back By the Numbers - 2014 in Review

We have now completed 4 years of trading the Horse Cove Absolute Return strategy. Here is a summary of the past four years:

Total Return Since Inception: 161.41%

Compounded Annual Return: 27.18%

Average Monthly Return: 2.10%

Winning Months: 41 Avg. Gain: 3.36%

Losing Months: 8 Avg. Loss: -5.31%

Compounded Annual Rolling Average Return: 30.38%

Compounded Annual Rolling Average Two Year Return: 32.51%

Compounded Annual Rolling Average Three Year Return: 30.38%

Best 12 Month Return Since Inception: 57.44%

Worst 12 Month Return Since Inception: 9.36%

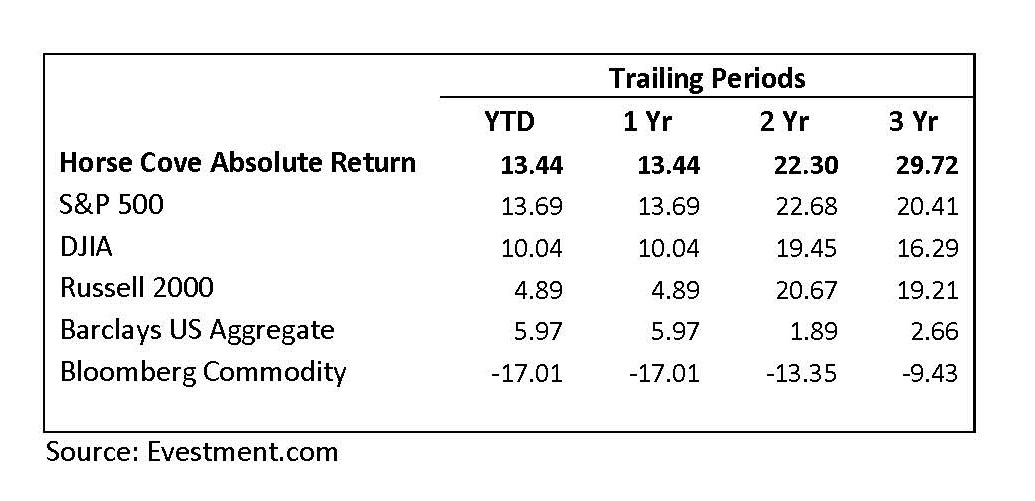

So how does that stack up? One could compare our results against any number of indices and benchmarks. We leave it up to you to find the one that best matches your preferences on how you compare your investments against one another.

Here are some suggestions:

Barclay Hedge Fund Index with 298 firms reporting, 2014 annual result: 3.67%

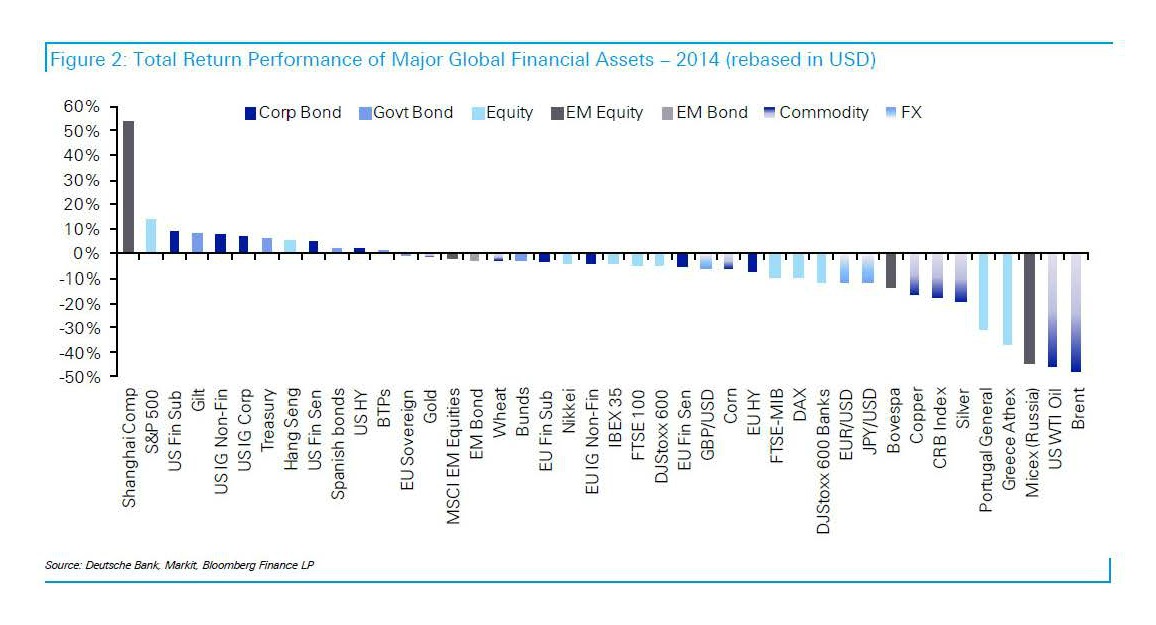

Over at Zerohedge.com, Deutsche Bank compiled a list of the best and worst performing asset classes in 2014: Horse Cove would have been number 3 out of 42, trailing only the Shanghai Composite and just barely third to the S&P 500 Total Return Index.

http://www.zerohedge.com/news/2015-01-05/best-and-worst-performing-assets-2014

Horse Cove Update

We received an Award of Excellence from Barclay Hedge as the No. #3 Best Return Strategy in the Option Volatility Category for November 2014.

With the addition, during the quarter, of 6 new accounts--representing $6 million in new assets, the total assets under management now exceed $14.3 million in the Horse Cove Absolute Return strategy.

We value each of our clients and the assets each has entrusted to us in our strategy and will continue to pursue attractive returns to the benefit of all.

About Horse Cove Partners LLC

Profiting from the art and science of taking risk.®

Horse Cove Partners was founded by Sam DeKinder and Kevin Ellis in January of 2013 with the commitment to help grow clients’ assets with a highly disciplined investment strategy, replicated weekly, to extract absolute returns from the market by trading short volatility option spreads. The firm was launched after more than two years of trading experience with personal assets that began in December of 2010. The firm is built on the strength of hedge fund trading expertise developed beginning in 2002.

“We do not believe we are smarter than the market, nor can we time the market in any given week or month. As a result, we take an investment approach similar to an insurance company in that our investment strategy focuses on probability of success and the management of risk. We believe that it is possible to realize positive returns through disciplined focus on the risk of each trade with a weekly investment horizon, and accepting intelligent losses when risk events occur.”

We would like to thank you for your continued support and look forward to being in touch with you in the near future.

Sincerely,

Sam DeKinder, Kevin Ellis

John Monahan and Michael Crissey

sdekinder@horsecovepartners.com

kellis@horsecovepartners.com

jmonahan@horsecovepartners.com

mcrissey@horsecovepartners.com

Horse Cove Partners LLC

1899 Powers Ferry RD SE

Suite 120

Atlanta, GA 30339

678-905-5723 main

1Net estimate on a consolidated basis of similar accounts as of 12.31.2014, which is preliminary and subject to revision. Performance estimate described herein as “YTD” are net of fees and expenses including a 2% per year management fee and 20% incentive fee and also assumes investors have been invested with no withdrawals.

THIS MESSAGE AND ANY FILES TRANSMITTED WITH IT ARE CONFIDENTIAL AND PRIVILEGED. IF YOU ARE NOT THE INTENDED RECIPIENT, PLEASE NOTIFY THE SENDER IMMEDIATELY AT 1 (978) 905 5723. IF YOU ARE NOT THE NAMED ADDRESSEE YOU SHOULD NOT COPY OR DISCLOSE THE CONTENT OF THIS MESSAGE AND OF ANY FILES TRANSMITTED WITH IT TO ANY OTHER PERSON.

Internet communications are not secure and subject to possible data corruption, either accidentally or on purpose, and may contain viruses. The content of this message should not be construed as an investment advice unless explicitly stated as such in the text of this message. Further, this message should not be construed as the solicitation of an offer to purchase or an offer to sell any securities or other financial instruments, including, without limitation, interest in any private investment managed by Horse Cove Partners LLC or any of its affiliated entities.

Finally, to the extent that performance information is contained in this message, you are hereby advised, and you acknowledge it, that past performance does not assure future results, which are not guaranteed by Horse Cove Partners LLC or any of its affiliated entities or by any insurance mechanism.

IRS CIRCULAR 230 NOTICE. Any advice expressed above as to tax matters was neither written nor intended by the sender or any Horse Cove Partners LLC affiliated entities to be used and cannot be used by any taxpayer for the purpose of avoiding tax penalties that may be imposed under U.S. tax law.