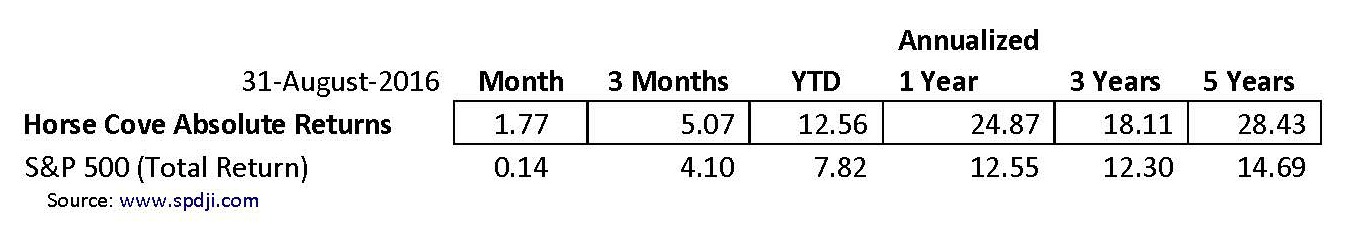

The August 31, 2016 month-end performance estimate for the Horse Cove Partners Absolute Return Strategy is +1.77% net of fees1. Since the December 2010 inception of trading, the Strategy has achieved a total cumulative return of +254.33%

Market Recap and Commentary

The S&P 500 Total Return Index was up 0.14% for the month, and is up 7.82% for the year.

The S&P 500 Index has been trading in a narrow range for more than seven weeks now. Perhaps it is the lazy days of summer, or perhaps the prolonged period of very low interest rates has run its course. The disappointing jobs number released on September 2 proved interesting when the market rallied on the news, indicating that the market "felt" the news would keep the Fed from raising rates later this month.

Volatility, as measured by the (VIX), continues to be very quiet. During the four weeks we wrote options in August, the average VIX at the time was 12.03%. The VIX remained in a tight trading range in August, from a low of 11.9% to an intra-day high of 14.24%.

Performance and Trading Update

For the month, the Horse Cove Absolute Return Strategy composite return was up 1.77%, compared with the S&P 500 Total Return Index that was up 0.14%. Year to date, the Strategy is up 12.56% compared to the S&P 500, up 7.82%.

We have been in a period of low volatility and this has translated into lower premiums accompanied by no pressure to take any defensive action. For the four weeks in August, we averaged 0.462% per week of gross return, which is at our average weekly gross return.

IRA Update

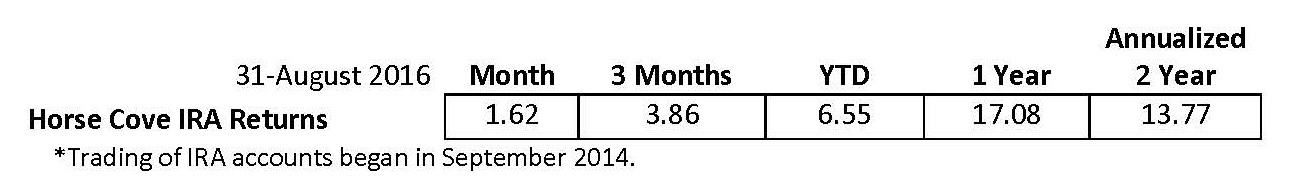

Here are the returns for the consolidated IRA accounts for the periods indicated:

IRA accounts must use Reg. T Margin which, means that fewer option contracts can be written than in the “regular” accounts that use Portfolio Margin. Over time, this will result in lower returns when compared to the “regular” accounts.

Where Do We Go from Here?

The answer to the question, “Where do we go from here?” is on most investor’s minds. We are entering the second year of nominal returns from the stock market. The “recovery” touted by the current administration has been tepid at best. There are over 90 million people not in the workforce, record numbers of people on government assistance in some shape or form, and a GDP growth rate of less than 2%, being fueled by zero interest rates and record borrowing, causing some to argue there actually has been no recovery.

We want to know the future and look to any number of ways to predict it. Financial experts are looking to see if Janet Yellen can somehow restore prosperity by the mere issuance of a proclamation on interest rates. Will keeping interest rates low and maintaining an environment of “free” money bring us prosperity? Better yet, will it cause the market to return investors 8% per year for the foreseeable future with no corrections, and a good paying job to anyone who wants one?

Given the randomness of it all, can anyone make those predictions with any consistency? We have not met any person or firm that has. For example, Goldman Sachs recently changed its prediction on the probability of the Fed raising rates in September from 40% to 55% then back to 40% in the course of less than a week!

You can look to the past for a pattern and the next time that pattern appears, extrapolate how the markets may react. You can engage in any manner of magical thinking, like wearing those lucky socks, or expecting that the actions of the Central Bank Policy makers will somehow make it different this time by doing the same things they have done in the past.

“Where do we go from here?” We don’t know. We find the best course of action is to not try to predict what is coming next, but rather rigorously replicating an established process that is probability based. This gives us the advantage of being right most of the time and then managing the risk to the portfolio when it’s not.

Please let us know how we can help you.

About Horse Cove Partners LLC

Profiting from the art and science of taking risk.®

Horse Cove Partners was founded by Sam DeKinder and Kevin Ellis in January of 2013 with the commitment to help grow clients’ assets with a highly disciplined investment strategy, replicated weekly, to extract absolute returns from the market by trading short volatility option spreads. The firm was launched after more than two years of trading experience with personal assets that began in December of 2010. The firm is built on the strength of hedge fund trading expertise developed beginning in 2002.

Assets under management at the end of August 2016 were $29.05 million.

“We do not believe we are smarter than the market, nor can we time the market in any given week or month. As a result, we take an investment approach similar to an insurance company in that our investment strategy focuses on probability of success and the management of risk. We believe that it is possible to realize positive returns through disciplined focus on the risk of each trade with a weekly investment horizon, and accepting intelligent losses when risk events occur.”

We would like to thank you for your continued support and look forward to being in touch with you in the near future.

Sincerely,

Sam DeKinder, Kevin Ellis

John Monahan

Michael Crissey

Don Trotter

sdekinder@horsecovepartners.com

kellis@horsecovepartners.com

jmonahan@horsecovepartners.com

mcrissey@horsecovepartners.com

dtrotter@horsecovepartners.com

Horse Cove Partners LLC

1899 Powers Ferry RD SE

Suite 120

Atlanta, GA 30339

678-905-5723 main

1Net estimate on a consolidated basis of similar accounts as of 8.31.2016, which is preliminary and subject to revision. Performance estimate described herein as “YTD” are net of fees and expenses including a 2% per year management fee and 20% incentive fee and also assumes investors have been invested with no withdrawals.

THIS MESSAGE AND ANY FILES TRANSMITTED WITH IT ARE CONFIDENTIAL AND PRIVILEGED. IF YOU ARE NOT THE INTENDED RECIPIENT, PLEASE NOTIFY THE SENDER IMMEDIATELY AT 1 (978) 905 5723. IF YOU ARE NOT THE NAMED ADDRESSEE YOU SHOULD NOT COPY OR DISCLOSE THE CONTENT OF THIS MESSAGE AND OF ANY FILES TRANSMITTED WITH IT TO ANY OTHER PERSON.

Internet communications are not secure and subject to possible data corruption, either accidentally or on purpose, and may contain viruses. The content of this message should not be construed as an investment advice unless explicitly stated as such in the text of this message. Further, this message should not be construed as the solicitation of an offer to purchase or an offer to sell any securities or other financial instruments, including, without limitation, interest in any private investment managed by Horse Cove Partners LLC or any of its affiliated entities.

Past Performance is not a guarantee of future results. Investing involves risk, including the possible loss of principal and fluctuation of value. The returns are based on the Investment Manager's strategy and not actual client accounts. The Horse Cove Absolute Return and IRA Return strategies seek to extract absolute returns from the market by trading short volatility option spreads. The strategies reflect the deduction of advisory fees and any other expenses that a client would have paid or actually paid. Model results do not represent actual trading and they may not reflect the impact that material economic and market factors might have had on the Portfolio Manager’s decision-making if the advisor were actually managing the clients' money. The S&P 500 index is used for comparative purposes only. The volatility of an index is materially different from that of the model portfolio. The S&P 500 refers to the Standard and Poor's 500 Index which is a capitalization-weighted index of 500 stocks. The index is designed to measure performance of the broad domestic stock market. The VIX (CBOE volatility index) is the ticker symbol for the Chicago Board Options Exchange (CBOE) Volatility Index, which shows the market's expectation of 30-day volatility. It is constructed using the implied volatilities of a wide range of S&P 500 index options. This volatility is meant to be forward looking and is calculated from both calls and puts. The VIX is a widely used measure of market risk and is often referred to as the "investor fear gauge." Option trading entails a high level of risk. The models do not include the reinvestment of dividends and capital gains because options don't pay dividends. Please read the Characteristics and Risks or Standardized Options available from the Options Clearing Corporation website: http://www.optionsclearing.com for further details.

IRS CIRCULAR 230 NOTICE. Any advice expressed above as to tax matters was neither written nor intended by the sender or any Horse Cove Partners LLC affiliated entities to be used and cannot be used by any taxpayer for the purpose of avoiding tax penalties that may be imposed under U.S. tax law.