The May 31, 2017 month-end performance estimate for the Horse Cove Partners Absolute Return Strategy is +2.29% net of fees1. Since the December 2010 inception of trading, the Strategy has achieved a total cumulative return of +303.03%.

Market Recap and Commentary

The S&P 500 Total Return Index was up 1.41% for the month.

Despite falling commodity prices and continued political turmoil in Washington, stocks climbed again in May. Stocks were bolstered by a steadying global economy and upbeat first-quarter corporate earnings. Once again, the S&P 500 pushed ahead to record levels. We saw the largest market loss of the year on May 17 due to the Trump/Comey report and we would expect these types of events to have a negative impact, as they call into question this administration’s legislative agenda: tax cuts, deregulation, and fiscal stimulus policies. All of which appear to have been priced into the market with an expectation of flawless execution.

Volatility, as measured by the VIX, continues to test record lows, reaching levels not seen since 1993 and closing four times this month in the single digits. This made for an average close of 10.86 in May, the second lowest monthly average in history. The VIX has now averaged 11.8 for the January-May period, the lowest ever for any comparable period. The VIX is down 29% in the past year. Despite this lack of volatility in the market, options trading volume has remained solid, even surpassing the past few years volume for this period.

Performance and Trading Update

For the month, the Horse Cove Absolute Return Strategy composite return gained 2.29% compared with the S&P 500 Total Return Index that was up 1.41%.

May was another solid month for Horse Cove Partners, pushing our YTD Absolute Return performance ahead of the S&P 500 for the first time this year. We collected outsized premium in the middle of the month, trading around the spike in VIX on the 17th. The sharp increase in VIX was attributed to reports of the President possibly pressuring his FBI Director to drop the investigation into Gen. Mike Flynn and the possible Russia election interference saga.

We saw no significant pressure on any of our strikes in May. All decisions to buy back short positions were strategic, or “artful.” Interactive Brokers continues to require historically elevated levels of collateral, in part because in this low VIX environment our probability calculation has us writing slightly closer to the market.

Here are the returns for the composite portfolio margin accounts:

Reg. T Update

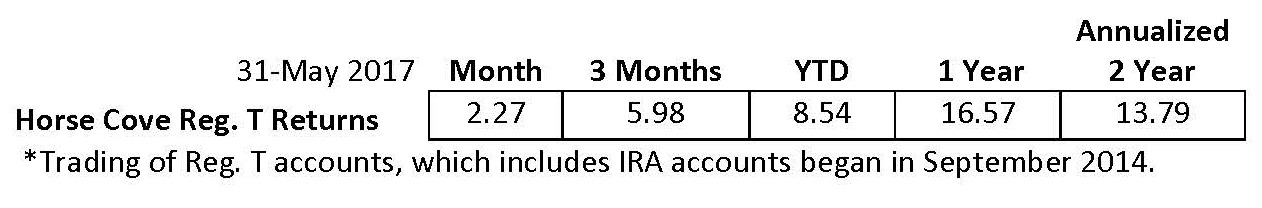

Here are the composite returns for the Reg. T accounts for the periods indicated:

IRA accounts must use Reg. T Margin which, means that fewer option contracts can be written than in the “regular” accounts that use Portfolio Margin. Over time, this will result in lower returns when compared to the “regular” accounts.

HC Income Update

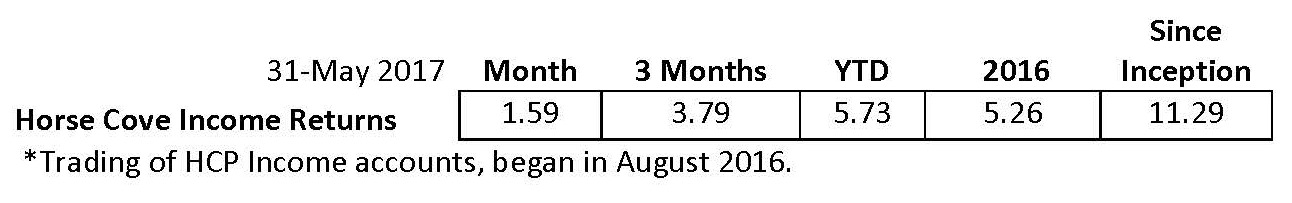

Here are the composite returns for the HCP Income Strategy for the periods indicated:

Keep Calm and Let Horse Cove Help Your Portfolio

Too good to be true? Has everything in world politics and the global economy been fixed? It seemed almost impossible to lose money in the stock market for the last two years. The markets have bounced back from a China currency scare in 2015, the fear of widespread bankruptcies from low oil prices in early 2016, as well as Brexit, Trump’s surprise election win, and most recently from reports that President Trump had pressured FBI Director Comey to drop the Gen. Flynn investigation. Moving forward, the markets will be tested by any number of events including the election in the UK, former FBI Director Comey’s testimony, continued tightening by the FED, as well as their attempts to reduce their balance sheet, continuation of the Russia investigation, and increasingly questionable implementation of the administration’s legislative agenda. But this is all business as usual and goes to the heart of our philosophy; no one can predict what the market is going to do, and the pricing of options is impacted by implied volatility which is almost always higher than realized.

In our last newsletter, we mentioned downside capture. Our strategy has shown a negative downside capture ratio of -69% since inception. That means that we have been positive when the market is down. There is also upside capture--and ours is 67%. If the S&P 500 was up 10%, we were up 6.7%. Our upside/downside capture numbers put us among a very elite group of money managers. According to a screen of managers on Morningstar (mutual funds and ETF’s), eVestment and HFR databases, with upside/downside capture ratios of 40%/-40% or more, Horse Cove is one of only 12 managers with these positive characteristics out of 33,579 screened for the period of January 2011 through March 2017.

A strategy that can perform well in both up markets as well as down markets; that does not require predicting how the market is going to react to upcoming events--reinforces our belief that the Horse Cove Partners Absolute Return Strategy deserves a role in most portfolios.

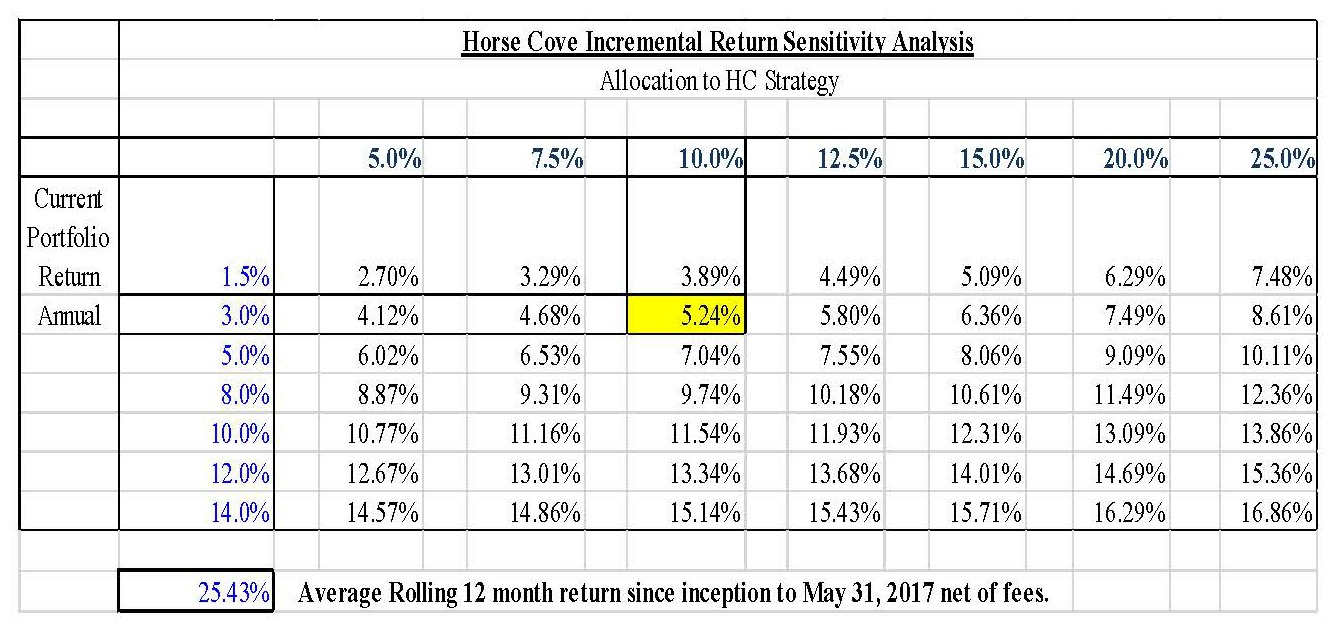

Below is a chart, that shows the impact of a 5% to 25% allocation to Horse Cove based on our historical performance and the resulting improvement to a total portfolio return. Find your portfolio’s annual return on the left, in blue, and see what the corresponding blended return would have been based on different levels of allocation.

Source: Horse Cove Partners LLC

Horse Cove Partners Update

We are delighted to introduce you to Fiona Dyer who joined the Horse Cove Partners team on May 15 as Manager of Operations and Customer Support. Ms. Dyer joined us from an Atlanta-based Hedge Fund and will be working as a point of contact for both new and existing clients.

Fiona is a native of the United Kingdom and received her BA in Economics from Columbia University.

About Horse Cove Partners LLC

Profiting from the art and science of taking risk.®

Horse Cove Partners was founded by Sam DeKinder and Kevin Ellis in January of 2013 with the commitment to help grow clients’ assets with a highly disciplined investment strategy, replicated weekly, to extract absolute returns from the market by trading short volatility option spreads. The firm was launched after more than two years of trading experience with personal assets that began in December of 2010. The firm is built on the strength of hedge fund trading expertise developed beginning in 2002.

Assets under management at the end of May 2017 were $71.64 million.

“We do not believe we are smarter than the market, nor can we time the market in any given week or month. As a result, we take an investment approach similar to an insurance company in that our investment strategy focuses on probability of success and the management of risk. We believe that it is possible to realize positive returns through disciplined focus on the risk of each trade with a weekly investment horizon, and accepting intelligent losses when risk events occur.”

We thank you for your continued support.

Sincerely,

Sam DeKinder, Kevin Ellis

Greg Brennan

Fiona Dyer

John Monahan

Michael Crissey

Don Trotter

sdekinder@horsecovepartners.com

kellis@horsecovepartners.com

gbrennan@horsecovepartners.com

fdyer@horsecovepartners.com

jmonahan@horsecovepartners.com

mcrissey@horsecovepartners.com

dtrotter@horsecovepartners.com

Horse Cove Partners LLC

1899 Powers Ferry RD SE

Suite 120

Atlanta, GA 30339

678-905-5723 main

1Net estimate on a consolidated basis of similar accounts as of 5.31.2017, which is preliminary and subject to revision. Performance estimate described herein as “YTD” are net of fees and expenses including a 2% per year management fee and 20% incentive fee and also assumes investors have been invested with no withdrawals.

THIS MESSAGE AND ANY FILES TRANSMITTED WITH IT ARE CONFIDENTIAL AND PRIVILEGED. IF YOU ARE NOT THE INTENDED RECIPIENT, PLEASE NOTIFY THE SENDER IMMEDIATELY AT 1 (678) 905-5723. IF YOU ARE NOT THE NAMED ADDRESSEE YOU SHOULD NOT COPY OR DISCLOSE THE CONTENT OF THIS MESSAGE AND OF ANY FILES TRANSMITTED WITH IT TO ANY OTHER PERSON.

Internet communications are not secure and subject to possible data corruption, either accidentally or on purpose, and may contain viruses. The content of this message should not be construed as an investment advice unless explicitly stated as such in the text of this message. Further, this message should not be construed as the solicitation of an offer to purchase or an offer to sell any securities or other financial instruments, including, without limitation, interest in any private investment managed by Horse Cove Partners LLC or any of its affiliated entities.

Past Performance is not a guarantee of future results. Investing involves risk, including the possible loss of principal and fluctuation of value. The returns are based on the Investment Manager's strategy and not actual client accounts. The Horse Cove Absolute Return and IRA Return strategies seek to extract absolute returns from the market by trading short volatility option spreads. The strategies reflect the deduction of advisory fees and any other expenses that a client would have paid or actually paid. Model results do not represent actual trading and they may not reflect the impact that material economic and market factors might have had on the Portfolio Manager’s decision-making if the advisor were actually managing the clients' money. The S&P 500 index is used for comparative purposes only. The volatility of an index is materially different from that of the model portfolio. The S&P 500 refers to the Standard and Poor's 500 Index which is a capitalization-weighted index of 500 stocks. The index is designed to measure performance of the broad domestic stock market. The VIX (CBOE volatility index) is the ticker symbol for the Chicago Board Options Exchange (CBOE) Volatility Index, which shows the market's expectation of 30-day volatility. It is constructed using the implied volatilities of a wide range of S&P 500 index options. This volatility is meant to be forward looking and is calculated from both calls and puts. The VIX is a widely used measure of market risk and is often referred to as the "investor fear gauge." Option trading entails a high level of risk. The models do not include the reinvestment of dividends and capital gains because options don't pay dividends. Please read the Characteristics and Risks or Standardized Options available from the Options Clearing Corporation website: http://www.optionsclearing.com for further details.

IRS CIRCULAR 230 NOTICE. Any advice expressed above as to tax matters was neither written nor intended by the sender or any Horse Cove Partners LLC affiliated entities to be used and cannot be used by any taxpayer for the purpose of avoiding tax penalties that may be imposed under U.S. tax law.